Time to do your taxes right?

If you're looking for a cheap option for tax preparation, you're probably considered Intuit's TurboTax software. For years, I used TurboTax when I was working a corporate job at Northrop Grumman. It was easy to use, affordable, fast, and more importantly, accurate.

TurboTax Free Edition is their free version. It's $0 to prepare your Federal return. It's $0 to prepare your state return. And it's $0 to file both returns.

There is, however, a minor catch. It's only meant for the simplest of tax situations.

If you only have:

Get help signing in to your TurboTax Online account to start your tax return with TurboTax #1 best-selling tax software. Get H&R Block 2018 Back Editions tax software, federal or state editions for 2018. Start tax preparation and filing taxes for 2018 with H&R Block 2018 Back Editions. TurboTax Deluxe + State 2018 Tax Software Sale! $ 59.99 $ 29.99 Read more; Related products. TurboTax Home & Business + State 2018 Tax Software For Mac Sale! $ 99.99 $ 54.99 Add to cart; TurboTax Business Bus Fed + Efile 2018 for PC Sale! $ 149.99 $ 89.99 Add to cart; TurboTax Premier 2018 Tax Software For PC Sale! $ 89.99 $ 44.99 Read more. TurboTax Home & Business is recommended if you received income from a side job or are self employed, an independent contractor, freelancer, consultant or sole proprietor, you prepare W 2 and 1099 MISC forms for employees or contractors, you file your personal and self employed tax together (if you own an S Corp, C Corp, Partnership or multiple owner LLC, choose TurboTax Business).

- W-2 income

- Limited interest and dividend income reported on a 1099-INT or 1099-DIV

- Claim the standard deduction

- Earned Income Tax Credit (EIC)

- Child tax credits

You're golden.

If you need any of these schedules… you will have to pay:

- Schedule A for itemized deductions

- Schedule C for business or 1099-MISC income

- Schedule D for stock sales

- Schedule E for rental property income

- or have credits, deductions and income reported on Schedules 1-6 (like student loan interest deductions)

If you have a more complicated return, then you will need one of the paid versions.

So before you start your tax return on TurboTax and discover which version of TurboTax you need (by then, let's be honest, you'll just pay for it because of the time you've just put in), why not use our handy guide to figure out which TurboTax version you'll settle on?

In all the questions and answers below, you can always use a more expensive version of TurboTax. We list the cheapest version you'll need. For example, if you sold stock, you'll need TurboTax Premier or better, which only includes TurboTax Home & Business.

So, which Turbotax do you need?

What can all versions do?

All of the paid versions include:

- The ability to prepare, print, and e-file your return,

- The ability to import last year's tax data,

- The ability to import from Quicken or Quickbooks.

Deluxe, Premier and Home & Business also include features that can help maximize your deductions. This includes ItsDeductible to help calculate the value of your deductions and the Audit RiskMeter to help reduce your chances of being audited.

Each one includes tech support but only Premier and Home & Business include phone support and guidance from Certified Public Accountants.

Do you only have Form-1099s?

If you only have a W-2 from work and various Form 1099s, you may only need TurboTax Basic.

The Form 1099's the Basic version supports are:

- 1099-MISC – Miscellaneous Income

- 1099-INT – Interest Income

- 1099-DIV – Dividend Income

- 1099-G – Certain Government Payments

- 1099-R – Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

These questions can help you figure out which version you need:

Do you own a home? Make donations?

If you want to itemize your deductions on a Schedule A, you'll need to get the Deluxe edition. The standard deduction for 2018 was $12,000 (increased by the Tax Cut and Jobs Act signed into law by President Trump) so it's possible you itemized deductions in the past but won't this year.

Do you run a business?

If you run a business, you need to declare your income on a Schedule C and so you must use TurboTax Home & Business. No other version offers this.

A business can be anything from a formal corporation with Articles of Incorporation to something less formal, like being a rideshare driver or selling clearance items on eBay. If you earned income from a side hustle, you will need to claim it on a Schedule C.

If you need them, TurboTax will help you create W-2s for your employees and 1099s for any contractors you paid throughout the year. It will also help you with self-employment tax as well as any business-specific deductions.

Do you own rental property?

If you own rental property and collected rent, you'll need to use TurboTax Premier because it includes Schedule E.

Did you sell stock, bonds, or mutual funds? (or other investments)

If you sold any investments (stocks, bonds, mutual funds, options, etc.) then you'll have to file a Schedule D – which also means you'll need TurboTax Premier.

If you received a Schedule K-1 (Form 1065), which you would get if you are in a partnership, that's another reason you'll need TurboTax Premier.

How much does each version cost?

When we looked up prices on Amazon, here were the prices for the digital download (Mac and PC prices were the same, the disc is sometimes cheaper):

- TurboTax Basic – $29.99

- TurboTax Deluxe – $39.99

- TurboTax Deluxe + State – $49.99

- TurboTax Premier + State – $69.99 ($54.99 as a disc)

- TurboTax Home & Business + State – $79.99 ($64.99 as a disc)

Turbotax Home & Business State 2018 Tax Software Mac Download Windows 10

As you can see, the first two versions (Basic and Deluxe), are available without State. You can't buy Premier or Home & Business without having it include State. If you don't have to file a state return, then those may be good options. If you do, adding on a State filing can be expensive.

Sometimes, it's possible to do the Federal return with software and to file your state return on paper. This can save you money and state returns are often less complex.

Can I Share TurboTax Software?

When you purchase the TurboTax software (disc or download), it says that it “comes with 5 free federal e-files.” This is actually an IRS rule, not a TurboTax one. The IRS only allows you to prepare and electronically file up to five federal and (related) state tax returns.

When you buy TurboTax, you're allowed to install it on any computer you own. When you do, you can prepare the returns of you and your immediate family. I've seen families do this alot where a parent does their returns as well as their children, often when they're in college.

If you're using the online version, you can only do one return.

What are some TurboTax alternatives?

Credit Karma Tax is the free tax service of Credit Karma, a popular credit score monitoring site that I have used for years. They offer free federal tax preparation and e-file, with many of the forms supported by Premier and Home & Business. They don't have a deluxe/premium paid version, it's 100% free with no upsells.

FreeTaxUSA is a popular alternative that offers a free federal return with e-file. They make money on the state return, which costs $12.95, and on the deluxe version, if you need extra customer support, which only costs $6.99. The deluxe version is only about support. Their free version includes much of what is included in TurboTax Premier (investments, rental income) and Home & Business (1099 income and expenses). You can see our full review of FreeTaxUSA for more.

I hope this guide helped you understand the differences between the versions!

Other Posts You May Enjoy

Description

Get a head start on your 2019 taxes. File your tax return electronically to receive your fastest tax refund possible. Connect with an expert in a click and get answers when you need them with SmartLook™. Every personal TurboTax return is backed by our Audit Support Guarantee for free one-on-one audit guidance from a trained tax professional. And much more!

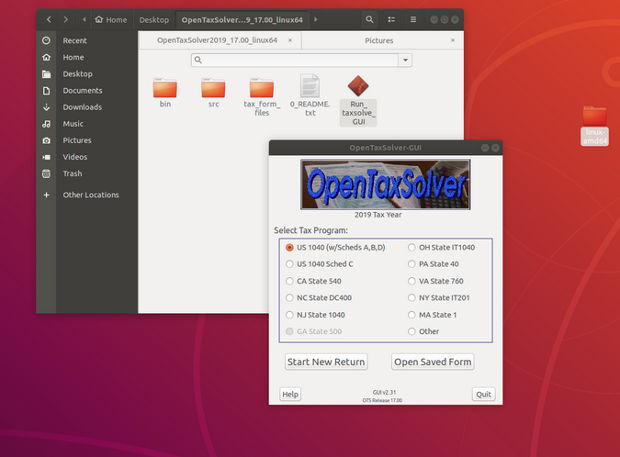

Screenshot

Download Links

Turbotax Home & Business State 2018 Tax Software Mac Download Mac

Intuit TurboTax Deluxe v2019.41.24.240 + Crack.zip (363.9 MB) | Mirror

Intuit TurboTax Home & Business v2019.41.24.240 + Crack.zip (363.9 MB) | Mirror

Intuit TurboTax Premier v2019.41.24.240 + Crack.zip (363.1 MB) | Mirror

Turbotax Home & Business State 2018 Tax Software Mac Download Free

Update + Crack Only

Turbotax Home & Business State 2018 Tax Software Mac Download Version

Intuit TurboTax v2019.41.24.240 Update + Crack Only.zip (182.2 MB) | Mirror